CANDLE STICK PATTERNS

What is a Candle Stick?

On a candlestick price chart, a candlestick is a single bar that displays a trader’s market movements at a glance. Each candlestick shows a market’s open price, low price, high price, and close price for a particular time.

- The body represents the open-to-close range.

- The wick, or shadow, indicates the peak and trough of the day.

- The hue indicates which way the market is moving – a green body indicates a price increase, while a red body shows a price decrease.

BULLISH CANDLE – STICK PATTERNS

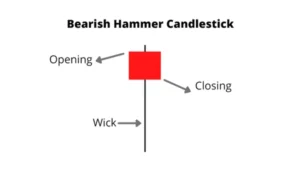

1. Hammer

- The hammer candlestick pattern consists of a small body and a long wick extending from the bottom.

- This pattern can be seen at the support line of a downward trend (see example below). Hammer candlesticks typically occur after a price decline.

- Hammer candlesticks indicate a potential price reversal to the upside. The price must start moving up following the hammer; this is called confirmation.

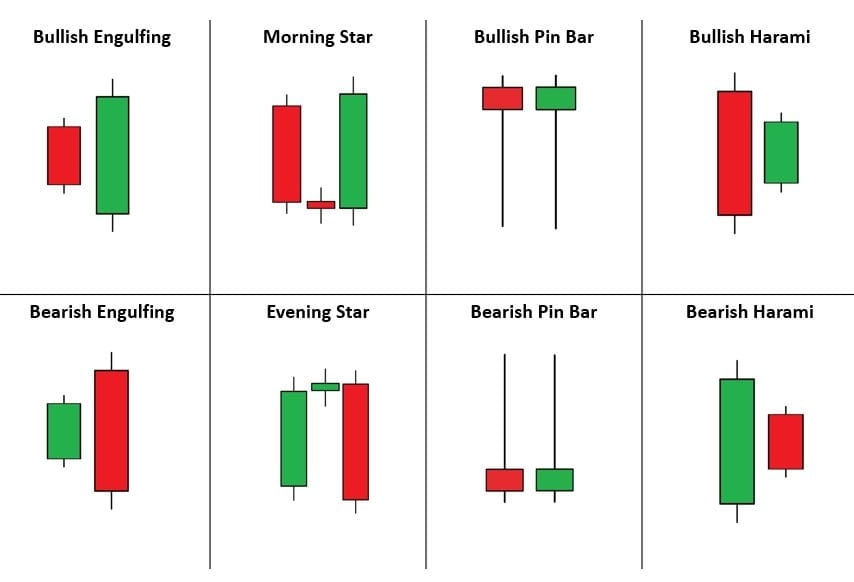

2. Morning Star

- This is a three-stick pattern: one short-bodied candle between a long red and a long green candle.

- The morning star’s middle candle depicts a pause in the market where bulls start to overtake bears.

- An upswing may be indicated by the third candle, which validates the reversal.

3. Bullish Engulfing

- The pattern of bullish engulfing is composed of two candlesticks. A larger green candle entirely engulfs the first candle, which is a short red body.

- The buying pressure increases, leading to a reversal of the downtrend.

- The second Bullish candlestick is engulfing the body of the first bearish candle stick.

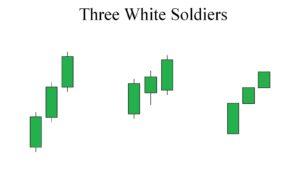

4. Three White Soldiers

- This pattern is made up of three long green candles in a row, this pattern also has to open and close higher than the previous period.

- Three White Soldiers is a strong bullish signal that shows up after a downtrend.

- This pattern is considered a credible reversal pattern when corroborated by additional technical indicators like the relative strength index (RSI).

BEARISH CANDLE – STICK PATTERNS

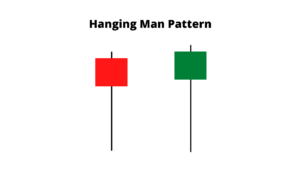

1. Hanging Man

- The hanging man candle has a slight natural body (distance between open and close) and a long lower shadow. There is little to no upper shadow.

- It shows up at the end of an uptrend, indicating that bears are stepping in.

- Extensive selling pressure was present during a part of the candle stick, which created a wick.

2. Shooting Star

- An inverted hammer is the antithesis of the shooting star. It comprises a red candle with a lengthy upper shadow and a short body.

- The market will often open slightly higher on the candlestick and close slightly below the open.

- A shooting star formation might have been a false indicator if the price increases afterward.

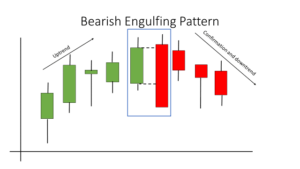

3. Bearish Engulfing

- A bearish engulfing pattern signals the conclusion of an upswing. What counts is the candlesticks’ “real body” or the difference between the open and closing prices.

- The down candle’s actual body must engulf the up candle.

- Anywhere might have a bearish engulfing pattern, including an uptrend or a pullback to the upside with a more substantial downturn.

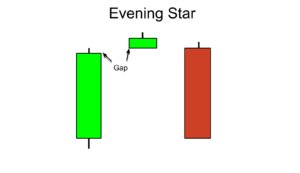

4. Evening Star

- The evening star is a three-candlestick pattern equivalent to the bullish morning star.

- It comprises a short candle sandwiched between a long green candle and a large red candlestick.

- Although this candle stick pattern is uncommon, traders regard the evening star pattern as a trustworthy technical indication.

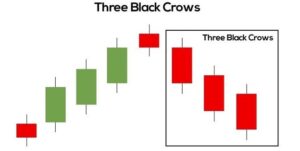

5. Three Black Crows

- The pricing charts show three bearish long-bodied candlesticks with short or no wicks.

- Every session begins at a price comparable to the last, but With every close, selling pressure drives the price down even further.

- Traders use it alongside other technical indicators, such as the relative strength index (RSI).

- The opposite pattern of three black crows is three white soldiers, which indicates a Bullish trend.

BILATERAL CANDLE – STICK PATTERNS

These candle-stick patterns can move in either direction.

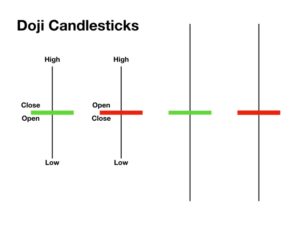

1. Doji

- Doji candlestick has an open and close that are virtually equal.

- It is crucial to stress that the Doji pattern denotes indecision rather than reversal.

- The market explores its upward and downward options, but cannot commit either way.

2. Spinning Top

- The candlestick pattern known as a spinning top features a short actual body centered vertically between the lengthy upper and lower wicks.

- Since buyers and sellers pushed the price but couldn’t maintain it, the pattern signals hesitation and that further sideways movement could follow.

- This candle stick pattern is much more robust in a trending market, whether uptrend or downtrend.